transfer taxes refinance georgia

Atlanta Title Company LLC 1 404 445-5529 Residential and Commercial Real Estate Lawyers 945 East Paces Ferry Rd Resurgens Plaza Atlanta GA 30326. Cobb and Gwinnett Counties have a county specific refinance form that must be used.

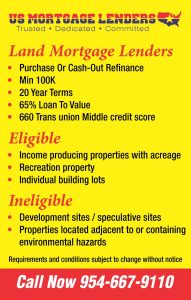

Georgia Mortgage 2 Homes 1 Parcel Or Lot Or Acres Mortgage Lenders

2400 12 680 034 None.

. 13th Sep 2010 0328 am. Georgias limit on the intangible mortgage tax is 25000 but that would involve a mortgage totaling over 8 million. Title insurance is a closing cost for purchase and refinances mortgages.

Atlanta Title Company LLC 945 East Paces Ferry Road Suite 2250 Resurgens Plaza Atlanta GA. 2010 Georgia Code TITLE 48 - REVENUE AND TAXATION CHAPTER 6 - TAXATION OF INTANGIBLES ARTICLE 1 - REAL ESTATE TRANSFER TAX 48-6-2 - Exemption of certain instruments deeds or writings from real estate transfer tax. The Georgia intangibles tax is exempt on refinance transactions up to the amount of the unpaid balance on the original note.

In a refinance transaction where property is not transferred between two parties no deedtransfer taxes are due. The borrower and lender must remain unchanged from the original loan. 20 license plate fee.

Buying a home in Georgia According to Zillow the typical home value in Georgia is lower than the typical value of 331533 across the US. Generally transfer taxes are paid when property is transferred between two parties and a deed is recorded. A transfer tax is the city county or states tax on any change in ownership of real estate.

The closing of a real estate transaction in Georgia must be performed by a licensed Georgia attorney. Total transfer tax. If the holder of an instrument conveying property located both within and without the State of Georgia is a nonresident of Georgia the amount of tax due would be 150 per 50000 or fraction thereof of the principal of the note times x the ratio of the value of real property located in Georgia to the value of all real property in-state and out-of-state securing the note.

The California Revenue and Taxation Code states that all the counties in California have to pay the same rate. 2010 Georgia Code TITLE 48 - REVENUE AND TAXATION CHAPTER 6 - TAXATION OF INTANGIBLES ARTICLE 1 - REAL ESTATE TRANSFER TAX 48-6-1 - Transfer tax rate 48-6-2 - Exemption of certain instruments deeds or writings from real estate transfer tax. To make this rate a bit more practical lets take a couple of examples based on the median home value in several cities.

Refinance Mortgage Transfer Tax in Georgia. Georgia Transfer Tax Calculator. See GACode 48-6-1 Tax rate for real estate conveyance instruments Georgia Code 2013 Edition There is imposed a tax at the rate of 100 for the first 100000 or fractional part of 100000 and at the rate of 10 cents for each.

It indicates the ability to send an email. The transfer tax rate in Georgia is 1 per 1000 of assessed value. The real estate transfer tax is based upon the propertys sale price at the rate of 1 for the first 1000 or fractional part of 1000 and at the rate of 10 cents for each additional 100 or fractional part of 100.

Georgia Transfer Tax On Refinance Real Estate. Title Insurance 200 per thousand of loan amount. As a first-time home buyer you would only have to pay a 75 transfer tax for a home price of up to 400000.

Atlanta Title Company LLC 945 East Paces Ferry Road Suite 2250 Resurgens Plaza Atlanta GA 30326. Title insurance rates will vary between title insurers in Georgia. For example in Michigan state transfer taxes are levied at a rate of 375 for every 500 which translates to an effective tax rate of 075 375 500 075.

Intangibles Mortgage Tax Calculator for State of Georgia. If a person is being added to the property deed at the time of refinancing then the person will have to pay the transfer taxes. That means a person financing a property for 550000 pays 1650 in intangible tax.

Georgia Transfer Tax 100 per thousand of sales price. The current tax rate is 110 per 1000 or 055 per 500. Real Estate- Transfer taxes are negotiable in the contract but in most states the seller pays the tax if its not addressed in the contract.

Real Estate Transfer Tax Declaration form missing from deeds. If the refinance is with the same lenderborrower then a refinance form must be completed. Note that transfer tax rates are often described in terms of the amount of tax charged per 500.

Your transfer tax is equal to a percentage of the sale price or appraised value of the real estate that you buy or sell. State of Georgia Transfer Tax. Once the tax has been paid the clerk of the superior court or their deputy will attach to the deed instrument or other writing a certification that the tax has been paid.

Georgia Transfer Tax Calculator. Who pays transfer tax at closing. How Much Are Transfer Taxes in Georgia.

On any amount above 400000 you would have to pay the full 2. The State of Georgia Transfer Tax is imposed at the rate of 100 per thousand plus 010 hundred based upon the value of the property conveyed. Title Ad Valorem Tax.

A property selling for 55000000 would incur a 55000 State of Georgia Transfer Tax. Requirement that consideration be shown 48-6-3 - Persons required to pay real estate transfer tax. Is there a transfer tax on a refinance.

It might also be added that apparently there is a transfer tax if you refinance and go from a title in a persons name to a title in that persons TRUST. I am refinancing my current mortgage and one of my potential lenders is stating that I need to a pay a mortgage transfer tax at closing. This title calculator will estimate the title insurance cost for 1 - 4 unit residential and refinance transactions.

Requirement that consideration be shown OCGA. The tax applies to realty that is sold granted assigned transferred or conveyed. Georgia Title Transfer Tax Intangibles Tax Mortgage TaxReal Estate Details.

In some states the transfer tax is known by other names including deed tax mortgage registry tax or stamp tax. Every Georgia owner other than a licensed dealer must obtain a title in their name for the vehicle before transferring ownership when the vehicle requires a Georgia title. Payment of all fees andor taxes due.

Intangible Tax 300 per thousand of the sales price. Atlantas median home value is 208100 which means the transfer tax would be around 208. Currently the intangible tax is imposed at the rate of 150 per 500 or 3 per 1000 based upon the loan amount.

For example on a 500000 home a first-time home buyer would have to pay 400000 75 100000 2 3200 in transfer taxes. So if your home sells for 600000 the property transfer tax is 660. 07th Sep 2010 0515 pm.

Easily estimate the title insurance premium and transfer tax in Georgia including the intangible mortgage tax stamps.

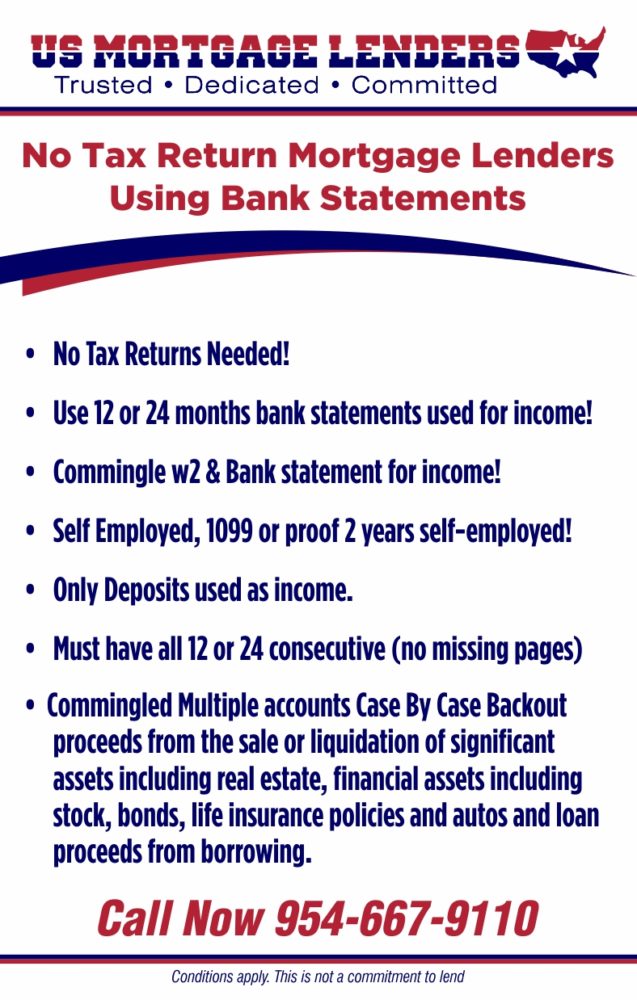

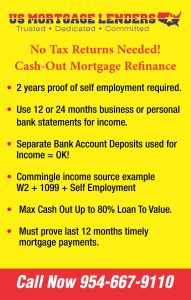

Bank Statement Georgia Mortgage Lenders No Tax Returns Needed

What Are The Costs Associated With Selling A Home In Georgia Brian M Douglas

Georgia Real Estate Transfer Taxes An In Depth Guide

Georgia Title Transfer Tax Intangibles Tax Mortgage Tax

Georgia Title Transfer Tax Intangibles Tax Mortgage Tax

Georgia No Tax Return Bank Statement Mortgage Lenders

7 Useful Things You Need To Know About Georgia Quit Claim Deed Forms The Hive Law

What You Should Know About Contra Costa County Transfer Tax

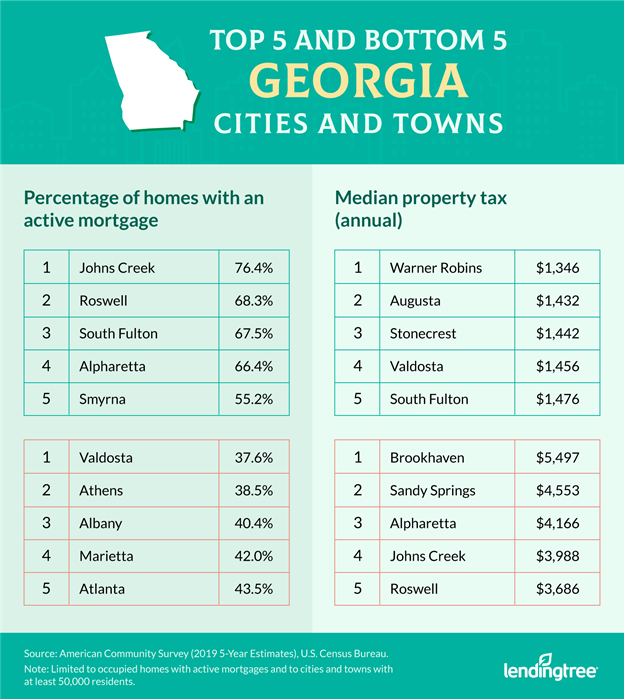

Mortgage Rates In Georgia Plus Stats

Transfer Tax Calculator 2022 For All 50 States

6 Mistakes To Avoid When Refinancing Your Home Georgia S Own

Georgia Mortgage 2 Homes 1 Parcel Or Lot Or Acres Mortgage Lenders

Transfer Tax Alameda County California Who Pays What

Georgia Closing Costs How Much Are They Calculator Property Title Search Title Insurance Attorney Fee Lender Fee Transfer Tax Mortgage Rates Today

Georgia Mortgage 2 Homes 1 Parcel Or Lot Or Acres Mortgage Lenders